According to AMI's recently published European Plastics Industry Report 2011, 2010 saw a recovery in demand for most thermoplastics, after two of the worst years the industry has seen since the oil shocks of the 1970s.

According to AMI's recently published European Plastics Industry Report 2011, 2010 saw a recovery in demand for most thermoplastics, after two of the worst years the industry has seen since the oil shocks of the 1970s. After a drop in demand of over 15% over the period of the recession, volume demand showed a modest 4% recovery in 2010 bringing total demand to just over 37 million tonnes.

The market has been driven by a strong recovery in German-speaking Europe and by a reversal in the fortunes of the automotive industry, which had been one of the sectors hardest hit by the downturn.

This was evidenced by a sharp bounce back in demand for engineering polymers which had tended to see the highest percentage drops in demand. While most sectors reported continuing growth in the first half of 2011, by mid-year signs of a slowdown were beginning to emerge and full year is expected to pan out at about half the rate achieved in 2010 and only slightly ahead of GDP. The recovery has in general been erratic and patchy and means that overall the European market still has some way to go to regain all the volumes lost from the 2007 peak when the market reached over 41 million tonnes.

The recovery in demand over the past two years has also at times been challenged by issues around availability of raw materials and pricing volatility. In addition to polymer prices rising on a almost constant basis from December 2009 through to June 2011, because of increasing feedstock costs, converters have also had to contend with record high prices and severe shortages for a whole range of pigments and additive materials used in plastic products.

The European plastics industry operates as part of a global industry which is heavily influenced by buying patterns around the world. Booming demand in Asia, particularly in China, but also in Russia and India, sucked raw materials away from European markets. Supply was further constrained by delays in new polymer capacity coming on stream in the Middle East and cutbacks in capacity within Europe, various plant outages caused by feedstock shortages and strikes (in France) which all contributed to periods of tight supply through 2010 for various materials but particularly grades of LDPE, PP and polystyrene.

While certain applications regained nearly all the volumes lost through the effects of the destocking and low consumer confidence seen in 2009, others are witnessing more fundamental structural changes which has impacted on their demand trends. Trends in light weighting, recycling, environmental and sustainability issues continue to challenge plastics usage in a variety of applications, but particularly in packaging. PET, for example, is seeing much slower growth now even though there are still lots of developments in new markets and applications e.g. in beer and wine packaging, because of growing availability of recycled PET, constant drives to reduce bottle weights and changing consumer drinking patterns.

The recession and its recovery has also brought about a reversal in fortunes for some countries. Whereas a few years ago Germany was seen as a mature, slow growing market with its plastics processing industry moving into Central Europe, the strength of its manufacturing industry and economy is now the engine for growth in Western and Central Europe. The bright prospects expected for Europe's Southern countries, Spain, Portugal, Italy and Greece, have now all faded away in the face of bursting asset bubbles and massive government deficits. Growth in plastics processing in these markets, if there is to be any, will mainly be driven by manufacturing exports as local building and consumer markets remain weak.

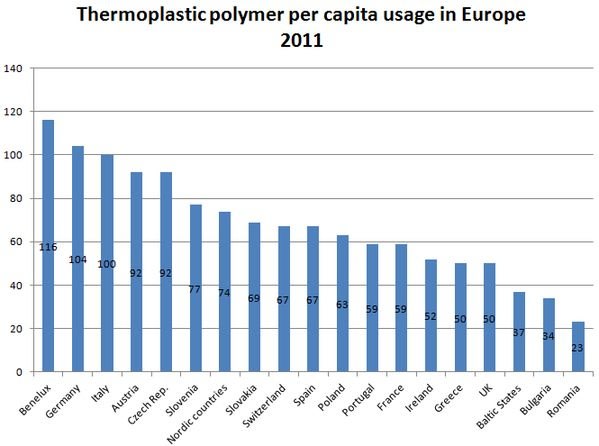

Another impact of the downturn has been a shrinking in per capita demand of thermoplastics (based on plastics conversion, rather than the demand for plastic goods). Per capita use of polymer in 2011 stands at just short of 74kg/head compared with over 82kg/head in 2007. As would be expected levels are generally higher in Western Europe than in Central Europe, although countries such as the Czech and Slovak Republics, Slovenia and Hungary are now higher than many West European countries highlighting the shift eastwards of polymer consumption.

UK now has the lowest level of per capita demand for thermoplastics in Western Europe highlighting the decline in plastics processing that has occurred there over the past decade. The Benelux region continues to have the largest per capita consumption largely because of the presence of some major export-oriented processors in plastics film, fibre, compounds and masterbatch.

For 2011 AMI expects that polymer demand growth will stay slightly ahead of GDP growth at just over 2% bolstered by the stronger demand achieved during the first half of the year to counteract the weakening sentiment in the second half of the year. The growing maturity of the plastics processing industry in Europe means that future growth will increasingly be pegged to GDP.