Waste management is currently one of the main challenges faced by the African recycled polymer supply chain. Population growth rates are over 2% per year and the consequent increase in consumption of plastic packaging makes this the largest fraction of waste after organic, which brings more urgency to the waste management challenges.

Most of Africa’s population has no access to kerbside collection nor a formal waste collection system and relies heavily on waste pickers in the informal sector for waste collection and sorting. According to industry estimates 90% of waste still ends up in landfill or illegal dumping sites, some even burned in the open.

Thirty-four African governments have implemented or are planning to implement different types of plastic bans, many of these targeting plastic bags, to tackle the rise in plastic waste generation.

Extended Producer Responsibility (EPR) initiatives in Kenya, Ghana and Nigeria are also encouraging, with the most recent EPR scheme being implemented in South Africa applied to all companies importing or manufacturing plastic packaging for distribution from 5 May 2021. Particular to the region, brands have often taken action and led these types of bans and EPR schemes.

Recycled content targets for plastic packaging set by legislation in other regions, coupled with consumer pressure, have pushed brands who operate in multiple regions to set sustainability pledges at a global level.

Now, these Fast Moving Consumer Goods (FMCG) brands are also looking for supplies of high-quality recycled plastic in Africa, particularly for polyethylene terephthalate (PET), polyethylene (PE) and polypropylene (PP) packaging.

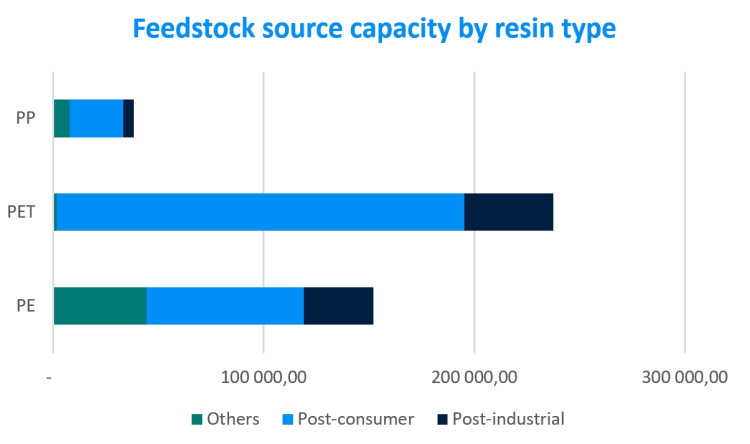

The ICIS Mechanical Recycling Supply Tracker has identified just under 50 mechanical plastic recycling plants for PET, PE and PP in the African region with a total capacity of over 370,000 tonnes/year for post-consumer and post-industrial waste feedstocks. 55% of the recycling capacity is allocated to recycling PET, and the majority of the polyolefin recycling capacity is allocated to PE. However, in 2020, production of recycled PET, PE and PP represented only 3% of total virgin and recycled PET, PE and PP consumption in the region.

The African plastic recycling industry is very fractured and fluid, with players entering and exiting the market frequently. Also, end markets are less well established in the region for the different grades of recycled plastic, further slowing the growth of the industry.

Due to the lack of end markets for recycled material, the majority of recyclers located in the northern part of Africa export a lot of their recycled product to Europe where demand for recyclate is much higher than in the domestic market.

High quality recycled plastics require high quality post-consumer waste feedstocks. In Africa, 81% of PET, 49% of PE and 67% of PP capacity is from post-consumer feedstock. Food and beverage brands looking to meet their sustainability targets need the highest quality food grade recycled material, suitable for food contact applications.

Most PET is recycled from beverage bottles, however, this currently feeds mainly into the fibre industry in Africa. There are three PET recyclers in Morocco, Egypt and South Africa with US FDA (Food and Drug Administration) Letter of No Objection (LNO) and EU EFSA (European Food Safety Authority) positive opinion, processing 21% of post-consumer PET feedstocks in the region.

Announced expansions in 2021 and 2022 will see food grade recycled PET (R-PET) capacity increase by up to 40,000 tonnes/year, looking to meet the demand for high quality recyclates from both inside and outside the region.

Up until 2018, Africa was a net exporter of plastic waste with China being the number one destination. In January 2018, China implemented its National Sword policy banning imports of plastic waste into the country. Since then, plastic waste exports from Africa have dropped: 2019 volumes only 45% of what was exported in 2017, and 17% in 2020.

Access to this plastic waste is an opportunity to develop the plastic recycling industry within the region rather than the current focus on trade outside the region.

Investment in infrastructure will help to improve collection and sorting, increase recycling capacity and build end markets for recyclates in the domestic market.